Hi all,

As we are all busy plotting and eagerly waiting for Monday’s trading date, wanted to start a discussion around the various ways to best invest around Chia. Asked on reddit but can’t discuss price over there.

Given the hype (and potentially price) building every day, I started looking at alternatives that also might provide good exposure as well. Wanted to run down pros/cons/thoughts I had of the various investments benefiting from Chia’s success and would love to collaborate with the community. While us small farmers might not have a ton of XCH, we are helping this become a success and would love to get some more upside before this gets mainstream.

DISCLAIMER: Nothing here is financial advice. I am not a professional and do your own research before investing! I’m long KHRIF, STX, CRSR and you best believe I’m going to try to get some more XCH come next week.

Running down my ideas from most to least direct Chia exposure:

1. Invest in Chia Coin

-

What we know:

- Transactions starts Monday, May 3rd at 10am PST, exchanges are TBD due to NDAs, but in the past both Coinbase and bitstamp have voiced interest having Chia on the platforms.

- There are a number of exchanges selling IOUs all in the $1-$2k range,one outlier in the $9k range outlined here

-

Thoughts:

-

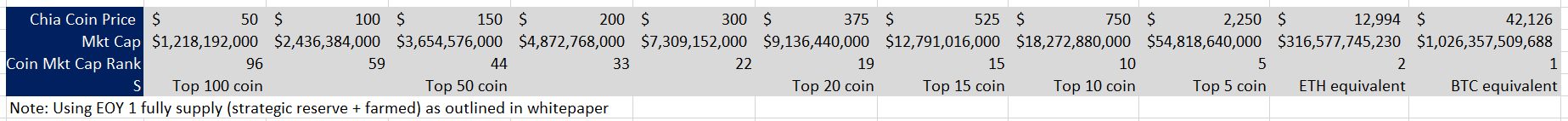

Below is a breakdown of Chia’s price, the resulting market cap, and how they’d rank in among cryptos.

-

Short Term: Feel with the rockstar team and explosive growth so far this should be a top 15-20 coin. Not much higher given proof of space/time still needs to be battle tested and there’s the whole ecosystem that needs to be built on top. Granted given the hype/how fast momentum moves in crypto/how little liquidity there might be at first with a good chunk of farmers hodling we could see it move much higher.

-

Long Term: I do think this has the potential to be bigger than eth and btc given it is structurally in a better position to capture the backend for the payments/currencies space. Why? The biggest priority for nation states and large multinationals looking at crypto for their rails is security. Do you think the US/EU looking into the digital dollar/Euro or a payments provider would design a system today where majority of PoW mining/processing is already in China/Russia/Iran (>75%) and could be used to attack the system? No, they’d build a system that would negate that ten-year head start building up processing power. Same with PoS that just requires gobs full of money that another nation state could easily coordinate. It’s easier to concentrate power in PoW/PoS. Storage allows these states/firms a clean start in the verification armaments race that is harder to outdate than processing power in PoW and harder to coordinate than just money with PoS.

-

2.) Invest in Chia the company via their seed investor Cypherpunk Holdings

- What we know:

- Cypherpunk Holdings (CSE ticker: HODL, OTC: KHRIF) was a Chia seed investor in 2018 via a $300k SAFE note as confirmed by their CSE filings and crunchbase

- Majority of assets (>90%) are bitcoin so price movement looks correlated

- Looks to be one of the few, if only, direct equity exposures currently to chia

- Thoughts:

- Link to valuation analysis of holdings and impact of Chia investment

- Using the above valuation - while we don’t know the terms of Chia SAFE, if we assume a standard range for seed equity % and the value of Chia’s strategic reserve, their biggest asset, as a floor for their company valuation, there could be significant upside to Cypherpunks current price. Could be an alternative if you can’t get the coin on your exchange or if the coin price skyrockets out the gate. Biggest question marks here are the Chia coin price and Cypherpunk equity % so the sensitivity analysis at the bottom outlines the various scenarios. Think even with the coin trading in low $100s and a modest equity stake it could represent some decent upside.

*Biggest downside is it is thinly traded and would be very hard to put any real money to work. Stocks this illiquid could pose big risks getting in/out so trade at your own risk!

3.) Invest in “picks and shovels” equities enabling the Chia ecosystem

-

Pure storage plays: Western Digital (ticker: WDC) and Seagate (ticker: STX)*

- Thoughts: I thought these would have been good options play around next qtr earnings, but these have already been on a tear the past few weeks. I’ve been long STX but has a lot of the good news been baked in given their forward guidance? They even called out crypto mining on the earnings call. Another interesting tidbit from storage_JM in the recent Chia AMA is with these storage providers main customers the FAANGS, they will likely not pass on recent price hikes to these large, long term customers like they would for their retail side, especially if they view this demand shock as temporary. So price increases might not impact earnings as much as we think. If Chia becomes a longer part of storage demand it might be a different story.

-

Hybrid (storage + other PC components): Intel (ticker: INTC)

- Thoughts: While intel benefits from both the storage side as well as the processor side (for all the additional plotters/farming systems folks are buying), I just think intel is too large of a market cap to be materially impacted by chia at this point. Similar to above, if Chia becomes a mainstay in the storage market and it can enforce pricing power across all of its B2B storage customers, then it materially changes the picture.

-

Other PC components:

- Corsair (ticker: CRSR)

- Thoughts: Company is #1 in market share for high performance memory, computer cases, power supply units, and cooling solutions. With the amount of folks building new plotters/farmers, I think with at a $3B market cap it’s small enough that chia could have a material impact on earnings. Even more so, it’s ~33% off it’s all times highs hit in November when all the stay-at-home stocks were the rage, which gives me a bit more comfort than Seagate which is hitting all-time highs now. Given it has much more liquidity than Cypherpunk holdings (and so could put more money to work), think this could be my favorite among the equity plays.

- AMD (ticker: AMD)

- Thoughts: While I do think the company is too large for chia to have an impact just yet, their threadrippers are perfect plotting machines. Only thing intel has that’s close is the Xeon W3275 at 56 threads but are harder to come by. Wonder if/when it will start to play a factor…

- Corsair (ticker: CRSR)

So was a long-winded post but happy for any thoughts/feedback on my logic and for any other plays the community has been thinking of.

)

)