Dear Community,

It`s time for another update.

Performance report

I have been reluctant to post back recently. The Performance reports feature has been very frustrating for me, as im Stuck on the finish line.

Chia prooves to be very resistant to obtain a useful transaction history from due to a variety of reasons such as privacy features, non-deterministic approach and 2 Bugs in transaction classification I encountered.

I hence started my own transaction classification, which I need valid samples from transactions to build upon. I tried doing that manually but it’s not easy. There are plentiful types and combinations which additionally cause transactions in different wallets which have to matched up against each other.

For instance, a simple cat transaction causes a transaction from the cat wallet and an additional transaction on the xch wallet, if a fee was given. Andling all these cases manually, prooved to be near impossible due to the amount of possible combinations

I am now trying another approach in order to get reliable data: I will trigger each transaction type (send, receive, create offer, cancle offer, accept offer, offer got accepted, with fees, without fees) programatically on the testnet and fetch the transaction history after each iteration to see what changed.

Other resolved issues

I recently had failures to remove old offers from the market and finally chased the issue down to my wallets vm, where the drive was running full.

The root cause was the chia client which rann in full node mode instead of as value. This was a simple fix at least.

I am also still tracking down another issue which is bogging me since the beginning.

In rare occasions, I observe an orderbook from gate.io which has a price with a negative volume. In that instance, my application proceeds with an emergency halt in order to not work with corrupted data and for me to observe where the issue is coming from. I have validated my code bit by bit and the last thing where the issue can occur now is for some reason at my order book conversion or gate-io has a weird standard to report orderbooks in rare occursions. Anyways, It cant be long anymore, until this issue is resolved. Luckylie, the issue is non-critical for the operation but requires a manual restart of the services.

Improvements to the infrastructure

Due to the issue with the harddrive, I decided to improve my infrastructure. I set up mail servers to provide watchdog alerts in case of any failures. This is about to be implemented

Update to the webpage

Due to my frustration with the performance reports, I decided to take a break on that topic and focus on other parts of the project before getting back at the reports.

In the mean-time, I have been working on the webpage itself and I have created a product page for BTF. These changes are not yet online. I have them on my private testpage. The Mobile design rework is still outstanding, upon which I will publish the changes.

BTF Performance

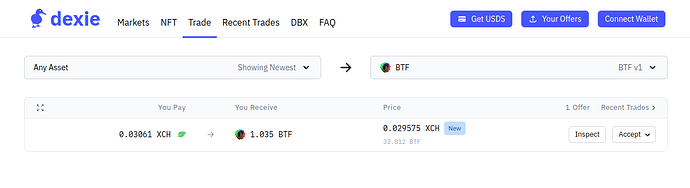

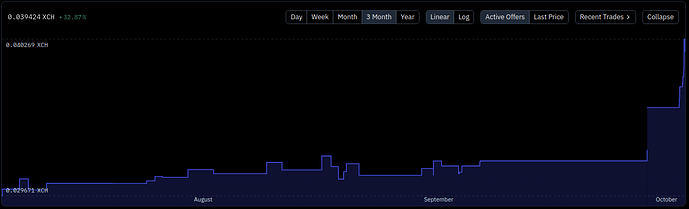

First of all, I am happy to report that I generated the first sale on the BTF Project. An unknown person purchased 1 XCH worth of btf. Said person sold the share the day after. Perhaps, because he or she was not convinced by the project, or for testing purposes.

Nontheless, I it is a first step

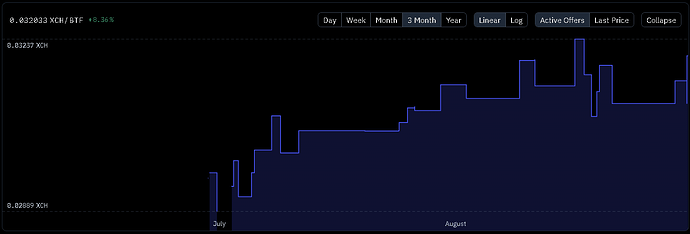

Furthermore, 3 Month performance of +20.14% over xch continues to look promising, altough the performance vs USDT in 3 Months is -8% After all we are in a bear market right now.

I am continuing to invest my farm’s rewards into the project for my personal portfolio management.

![]()