Can somebody explain what does he mean? Thank you.

See this thread.

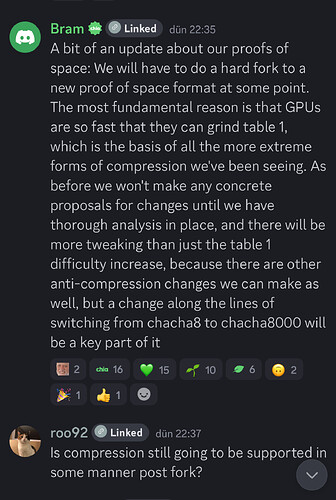

I’ve never heard of chacha8000. I assume he is referring to making the part of the plot that uses chacha algorithm much much harder, rather than incrementally harder by going to chacha9 (which I’ve never seen either)

Plot compression has been progressing much faster than they anticipated.

(and/or GPU development is going much faster than anticipated.)

And by this post, it would appear there is no longer confidence that the plot filter reduction will be enough to combat it.

They mean to end the “rat-race” or as the joke goes, “proof-of-replot” situation and create a more level playing field again that focusses on storage, as supposed to GPU power.

I haven’t seen this stated directly, but I assume this is also in the long term to make sure actual plot-grinding is kept at bay as well.

New plot format means a change to consensus, and therefor a Hard Fork (a new Chia version that is not backwards compatible with old versions).

And if the hard fork is successful, it also means everyone has to replot.

I think it’s a good idea. Chia is GPU hacked now.

I wouldn’t worry. I’m sure we will still have the same quality plotting/node/wallet software that CNI has always released. ![]()

So, just so I understand correctly……When they do a hard fork to support the new plot format won’t that pretty much make any chia that I hold pretty worthless? And they are going to issue themselves a new huge batch of premine coin? What happens to the value of all the old chia? I would assume that they would dump all their old premine coin on the market to get what they can…….so anybody holding the old coin will have a fist full of nothing? That sound about right?

Not quite. At the fork you end up with two copies of your coins. You are right about the pre-mine in that it gives them unfair control. It is centralized in their favour.

It also depends on if the hard fork is hostile or democratic

Yup, totally agree! Just as a point oif interest, here is what GPT-4 Turbo says about hard forks:

Understanding Blockchain Hard Forks and Their Impacts

Introduction

Blockchain hard forks are pivotal events that can significantly affect existing cryptocurrencies and their premine. In this report, we delve into the mechanics of hard forks, their implications, and considerations for investors and miners.

1. Creation of a New Blockchain

A hard fork represents a radical alteration to a blockchain network’s protocol, resulting in the emergence of two distinct branches. One branch adheres to the previous protocol, while the other follows the updated version. Consequently, an entirely new cryptocurrency is born.

2. Impact on Existing Coins

During a hard fork, the entire blockchain is duplicated before the fork event. Holders of the original cryptocurrency receive an equivalent amount of the new cryptocurrency. If you owned coins in the original blockchain at the time of the fork, you’ll retain the same quantity in the new blockchain.

3. Miners’ Decision

Miners face a critical choice during a hard fork: whether to continue validating the old blockchain or transition to the new one. Some miners may opt to remain with the familiar protocol, while others embrace the changes introduced by the fork.

4. Value and Functionality

The value and functionality of the newly created tokens can diverge significantly. These differences impact the overall cryptocurrency portfolio of investors. Ultimately, market dynamics determine the valuation of the fresh coins.

5. Premine Considerations

The premine—where a specific number of coins are mined before a cryptocurrency’s public launch—must align with the rules set by the new protocol. The specifics of premine handling depend on the unique circumstances surrounding each hard fork.

Conclusion

While the outcomes of hard forks vary based on specific contexts, staying informed about crypto developments is crucial. Consult with financial advisors and blockchain experts to navigate these events effectively.

So pretty much exactly what I have been saying since the first person figured out compressed plots. This is how all crypto goes, I am baffled they didn’t see this coming honestly. If anything in crypto is scalable for a gain of income, someone smarter then the developers will come along and figure out how to exploit it endlessly.

The first red flag should of been the first compressed plot ever made, not seeing how that would scale out over time with more powerful hardware overtime is extremely short sighted.

There response was always, it’ll never happen, or we’ll just increase the difficulty but they really still don’t understand crypto miners at all.

With how long they take to develop and implement changes, noSSD with have control of the blockchain by then and just refuse the merge if it means they no longer exist. So they better hurry up before someone figures out the 95%+ compression that could just generate the winning blocks on command and the project is completely dead and coins are removed of all value.

If they only make the algorithm harder but don’t fix the key flaw on how it was achievable in the first place, what will come next is ASIC miners figuring how how to do it and the difficulty increase will make no difference. Even if that miner costs $100k or more, someone will buy it and use it.

I bought my drives and never cared about ROI but it would be nice, so they will keep ticking along until I decide to unplug them. But that might be sooner then later if they drag their feet like they always do and chia just keeps dropping to near 0.

I was quite impressed by the 27 second Gigahorse plots Digital Spaceports dual RTX4090 machine could spit out.

But can you imagine what it must of cost, although Chia wasn’t the reason he bought it.

Yes, so a POW chia machine costs $5000 and gets one plot through the filter while using 600W…I think I’ll stick with disks and compression thanks. ![]()

I think the CPU alone was pretty much double that, then there’s the rest.