Follow up on estimates from previous post.

The farm did run 33 days without interruption. The real rewards with +/-2% accuracy??? (only time will tell) Project has been abandoned due to lack of profitability & energy efficiency.

The Farm

| spec |

value |

| plots |

4355 |

| space |

333.35TB/303.18TiB |

| space-effective |

474.25TB/431.33TiB |

| SW |

flexfarmer v2.4.1 |

| pool difficulty |

18 |

| Flexpool estimated earnings |

3.8 XCH/month |

| GPU |

nVidia Quadro M4400 |

| CPU |

AMD Ryzen 5 4500 3GHz@1V |

| RAM |

16GB DDR4-2133 C13 |

| MB |

ASUS ROG Crosshair Hero VIII Wifi |

| PSU |

Seasonic Prime-TX 750W ~90% efficiency |

Dataset

| Data |

unit |

| 4.35948817499473 |

XCH/month rewards Flexpool.io

|

| 144 |

kWh/month consumed by farm |

| 0.001001030579792 |

XCH/plot/month |

| 0.013929857409876 |

XCH/TiB/month |

| 0.474965367108648 |

kWh/TiB/month |

| 0.033065442020666 |

kWh/plot/month |

RESULTS

| rewards |

+14.7% |

compared to pool estimate - luck or just reality??? |

| reward per plot |

-1.28% |

lower than official plots (should be -3.125%) |

| rewards |

+36% |

XCH/TiB/month (based on real space used) |

| cashflow |

+25% |

higher income (depends on energy costs) |

| energy use |

+62% |

unless same HDDs used, accuracy is +/-20% |

Cashflow & ROI

There is a size mismatch, and ROI will be lower for MMX plots because they do not scale very well…ever increasing energy use with more plots.

- mmx c5 - rewards 134 CHF, costs -45CHF = +89 CHF cashflow. 20TB HDD ROI 4.65 years

- official - 20TB ROI 5.84 years

4 Likes

Thanks for the great post !!! I just think that you have low pool difficulty at 18. For your farm i think it should be around 80-90 and maybe that should reduce your wattage a little bit.

Did you find any blocks? I don’t believe our estimates include the 0.25.

The 14% boost would be in line with the 14.7%.

Higher diff will reduce power usage slightly

Your web stats show about 9 found blocks in the test period - it would be +2.25 XCH. I do not count luck because it is inconsistent. Official farm also found many blocks prior 11/2021 - I used to have 6-10 blocks/month on pool.space

According to MMX “anything above 20 diff makes very little difference. Most gains are 1-20 diff range”

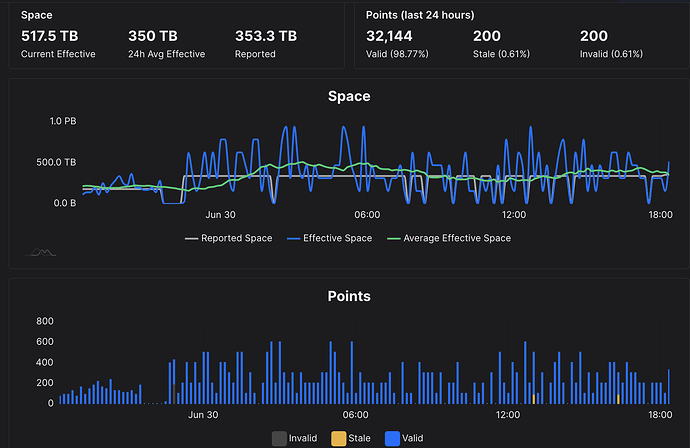

In my latest C5 plots project, I have tried diff 100, and this what happened -------->>>

I started to lose points, many invalids, stales, often 0 partials reported. I went back to diff 10. Farmer log no errors. There is a warning to not mess with diff. No idea whether rewards remain same, and just estimates are weird.

In CPU farming, diff doesn’t matter too much

Is it not possible to set difficulty automatically, as in ETH mining days?

pool server tuned difficulty based on hashrate

To my knowledge the only pools that did that got exploited like mad. None in the top 10 did.

Lower difficulty means more partials = more energy usage.

I have the same farm size as you and I am at 200.

So you’re saying madmax is wrong on this?

1 Like

rewards same?

There is a warning on Flexpool “incorrect stats”

when I saw invalids, stales…I used 10 diff. wattage is still same, around 125W (cpu farming C5…never tried by GPU farming)

So on a smaller scale mmx is still more profitable but you think as you scale up the power usage will offset the increased revenue basically? That’s kinda what I had assumed though I hadn’t done or seen any analysis this detailed and we didn’t have enough data to really accurately calculate it. I wonder what the numbers look like on the big farms. I still think I’m going to be very happy in the long run that I waited for the bladebit cuda. It seems that the increased energy from that will be minimal which will more than offset the slightly lower compression

1 Like

And those ROIs are just accounting for current storage costs right. Not including the jbods/servers/racks/networking/ and wte other costs that would be averaged in and would depend on scale correct? I mean on a really large scale it wouldn’t add much but small scam farms it could double the cost per TB or more which is why I’m assuming none of that is accounted for since it can’t be without knowing the scale of each farm. Also not accounting for halving im assuming right? Before compression I had figured around 10 years including all of that but that will be dependent on what the price does with the first halving it could be much longer or get shorter.

1 Like

you must always think about the margin of error. Estimates show 3.8 XCH, rewards paid last month as above by. It is 15% difference. Who knows whether it was luck, or you can use it long term.

You may have different HW, and it will be worse/better. I just shared my study - the objective of the study was to find out whether it makes sense or not.

I have long-term data only for official plots.

I happened to have free 350 TB of space. I am waiting for the official release - I do not like pooling, nor 3rd party stuff used in our network.

Right now, I like C5 CPU farming. Same size as above by, but it uses just 125Wh. We are building a green network, and it went south. Plotting speed increased, but farming efficiency per plot dropped significantly.

ROI is of course just an example for consumables such as HDDs. If you calculate HW, your time…you will never get it back unless XCH is >100$ That is the reason why is there no business interest.

I spent as little as possible. HW for farming 500$ max. Plotting HW max. 1000$. I can still sell it…people will kill for rig with dual CPU and 512GB RAM.

1 Like

On small scale is better CPU farming because GPU will always use around ~50-80W extra. With CPU farming, wattage is almost linear. With GPU it always goes up, until you need a faster GPU.

There was a guy with underclocked K2200, which did run an effective farm…he claimed.

Some guys suggested in the original post, GPU farming is only for guys with free energy. I pay 0.31CHF/kWh ROFL And our village has got 2MW hydro projects…still we sponsor poor people from the city

Yes, each partial gives you the difficulty in points.

So for example diff 20 vs diff 200 is 10x more partials but the same amount of points.

Your diff is way to low, hence the increased power usage…

Yeah I feel you there I have a bunch of storage sitting here too waiting for the official release with bladebit I don’t like the numbers with gigahorse I don’t think there’s any world where the extra power usage and extra fees will every be offset by the slight head start in compressing with that vs the bladebit which will be more efficient and have less costs and we will have more information at that point to know the ideal compression level vs just going for max compression right out of the gate and ending up burning all the earnings in power or wanted to replot it all when we realize long term that a lesser compression leads to higher returns. I think you’re right about the compression too I don’t think I will go any further than C5 but with bladebit maybe C6 idk yet. They put something out saying they will have an update coming after the release with C10 and C11 plotting to make it equal to the gigahorse C9 so somewhere around c5-c6 will probably be ideal.

We don’t even know what the effect is going to be when it halves. A normal crypto with normal trading volume and availability on the mainstream exchanges would see a price increase but we don’t even know what XCH price will do when it halves. We could potentially get our earnings cut in half with no trading volume to move the price anywhere and end up getting profits cut in half and have the ROI get almost doubled.

There are a lot of unknowns but there’s also a lot of delusional optimism when it comes to price on this. I don’t really understand how people think there can be any significant move in price I think we like to get optimistic about a project we’ve invested a lot in but the reality is they premined 21 million XCH and are holding them in reserve. From a business perspective I think their plan and what my plan would be in that position would be to hold that 21 million XCH, which prevents the price from moving anywhere and makes it so they don’t need to raise capital ro get a super high valuation for this IPO they’re pushing for, and then once it goes public they will slowly release the reserve since shareholders will demand it and will want to see dividends and price movement. This is all just a waiting period for them and as long as they hold all the XCH they hold all the power and they can wait it out as long as they need to with no risk of devaluation but also no chance of farmers seeing an increase in earnings which we will need to compensate for the halving.

At the very least we need to have a possibility of seeing the price move which they would need to release some of that reserve to make happen. Which is most likely the real reason it never got listed on coinbase or some other exchanges. A lot of exchanges probably won’t even touch it when they see that only a small percentage is actually being traded. We still haven’t even hit 8 million since the beginning and they still have 21 million in reserve. They said it would take 21 years for the post mined to match the premined reserve they have which I think was overstated but it will still be a long time before there will be enough in circulation to move the price. I don’t understand how people see the price all of a sudden going up related to the ipo or anything else going on because at the end of the say its still not enough volume to possible do much.

Don’t get me wrong it has benefits especially for those who one a percentage of the company and that reserve but it keeps the price stable. Who knows maybe it would have tanked and be finished by now if they didn’t do that so for longevity it has its benefits. But for us it’s not going to allow us to even compensate for halving if they still have 70% or wte it will be by then in reserve. I don’t think they have any plans to burn or release it either to enable price movement so idk what’s going to happen. They’re also using that reserve worth $700,000,000 or so and have been loaning a percentage of it out to corporations and earning returns on the loans this whole time so its pretty clear who’s actually profiting off this and it’s not the people still investing in it and mining it. The smart money is probably in the corporate stocki if they do get that ipo approved because they are sitting on an insane amount of semi-liquid capital. They obviously couldn’t just sell it all since iit would tank the price immediately so its not all liquid but from an investment standpoint, the company holding 21 million tokens worth $35-$40 each is a lot of capital to have on hand before even doing the ipo.

that is a good thing - the last thing you want are crazy kids pushing value +/- 20% in one day

Chia is intended for business - my bet is we get screwed along the way. We built it, and then it will be datacenter thing for players involved in EcoNazi movements.

My theory is, Chia is not listed too much because they do not want it. Just check out ETH and BTC. After 10 years there is still very little use, where is that value come from? ROFL

People love to dream, and I like it because it makes me lots of money  If you do just opposite what you think is “right”, you can retire within a few years.

If you do just opposite what you think is “right”, you can retire within a few years.

Money is what people choose as exchange of time. Money must be unique, easily swappable, liquid, and MOST IMPORTANTLY NOT LOSING VALUE.

There is one such a thing…gold/silver  Greatest day for crypto would be official ban, and move to DarkNet. Officially, crypto will be regulated to death.

Greatest day for crypto would be official ban, and move to DarkNet. Officially, crypto will be regulated to death.

My bet is on Monero, and Chia as business token.

1 Like

What I do no like most about compression is excessive wear of HDD. Every 10s head bursts, and does random seek. It doesn’t happen with official plots. It may kill your HDD before you get money back.

With ROI currently sitting at 5 years…you are in losing business…

if you have 0 points per hour, 100% invalids, stales…I doubt increased difficulty is any help

Then you have a problem with your farm, a dying disk may cause these kind of issues…